For a rule of thumb my money management strategy has not changed over my professional handicapping career. I wager 1-5.5% of my bank roll. 5.5% on my most confident plays and 1% on my least confident plays and it has produced huge results, especially in college football.

The purpose of this article is to compare betting on sports with the stock market against good growth stock mutual funds with long term yearly ROI’s of around 10-12% according to the market average. You can expect 12% yearly growth in the stock market if you know what you are doing. Actually it’s not that hard as long as you stick to simple plan and don’t get too greedy. Here is a great article on the 12% reality, “The current average annual return from 1926, the year of the S&P’s inception, through 2011 is 11.69%. That’s a long look back, and most people aren’t interested in what happened in the market 80 years ago.”

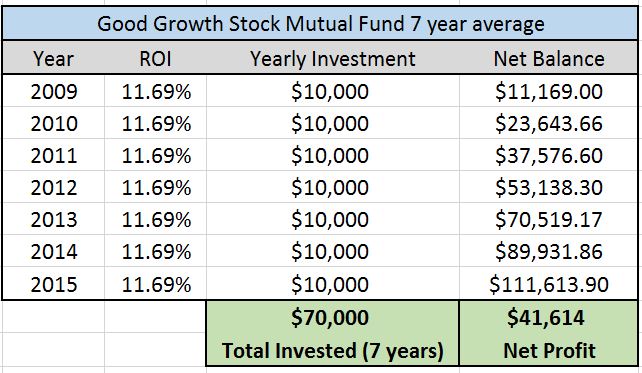

Now that’s great when you are talking about investing and earning a return on your money. Say you put in $10,000 a year into the S&P or similar growth stock mutual funds over a 7 year period. This is what you money looks like after 7 years, and I use 7 years, because that’s how long I have been in the business of professionally betting on sports.

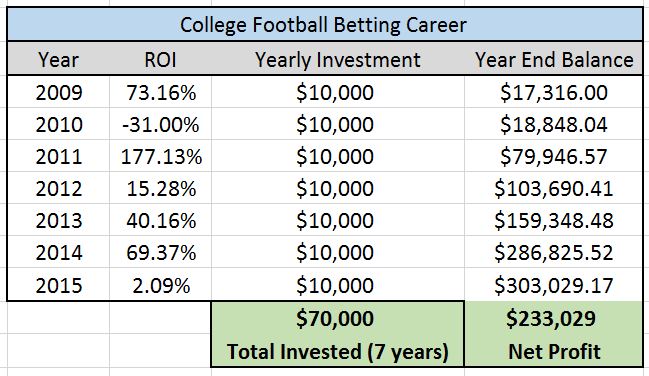

Not too bad right? This is what a typical investment portfolio looks like over a 7 year period if you are investing $10,000 per year and that’s great. It’s what I do to diversify my portfolio, but I also invest heavily in myself. This is what my last 7 years of college football look like and you can plug in your data into my college football ROI tool.

So instead of $41,613.90 in profit you would have profited $233,029 in a 7 year period by investing $10,000 into your portfolio year after year and following my money management strategy. It gives you an interesting perspective on comparing sports betting to the stock market. Especially if you are in an area where sports betting is legal. This is one way to diversify your portfolio and I highly encourage it, because you won’t ever see a 177% return on investment in your life in the stock market.